In a sliding market, Allegro MicroSystems has defied the odds, trading up to $24.11 per share. Its 7.4% gain since September 2024 has outpaced the S&P 500’s 1.1% drop. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Allegro MicroSystems, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

We’re glad investors have benefited from the price increase, but we're swiping left on Allegro MicroSystems for now. Here are three reasons why there are better opportunities than ALGM and a stock we'd rather own.

Why Do We Think Allegro MicroSystems Will Underperform?

The result of a spinoff from Sanken in Japan, Allegro MicroSystems (NASDAQ:ALGM) is a designer of power management chips and distance sensors used in electric vehicles and data centers.

1. Long-Term Revenue Growth Disappoints

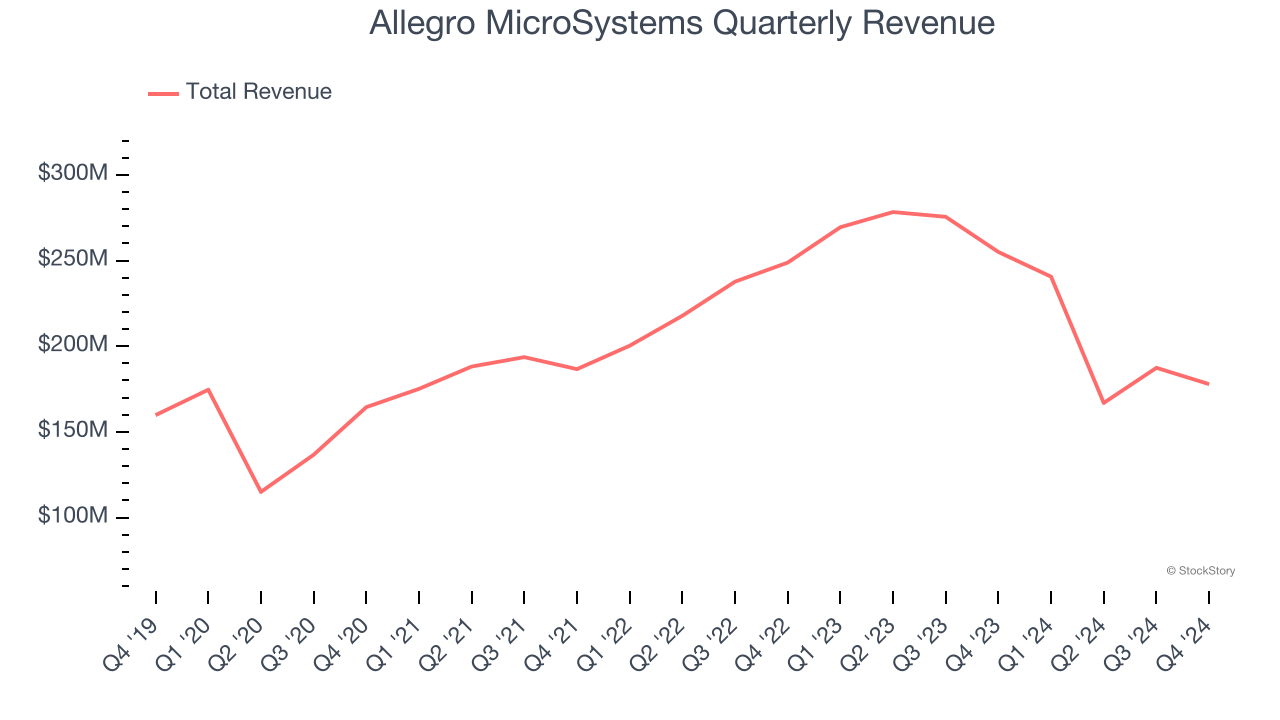

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Allegro MicroSystems grew its sales at a tepid 5.1% compounded annual growth rate. This was below our standard for the semiconductor sector. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. EPS Trending Down

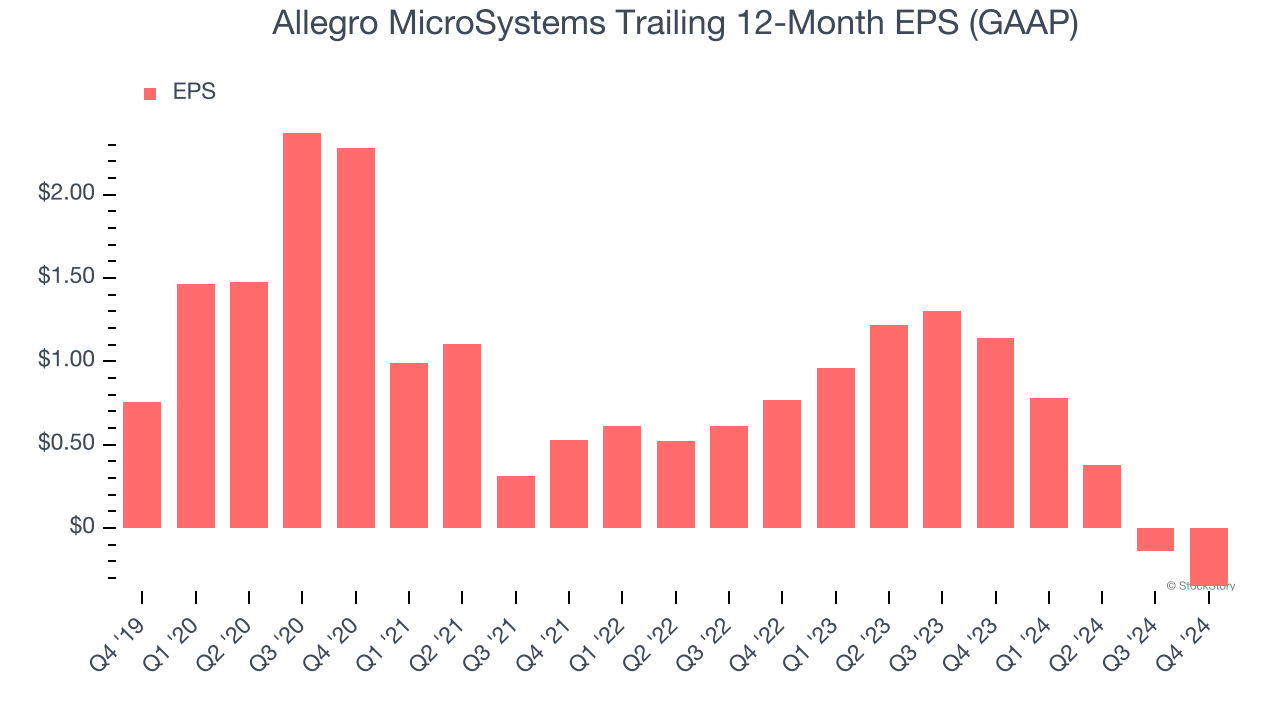

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Allegro MicroSystems, its EPS declined by 19.8% annually over the last five years while its revenue grew by 5.1%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Free Cash Flow Margin Dropping

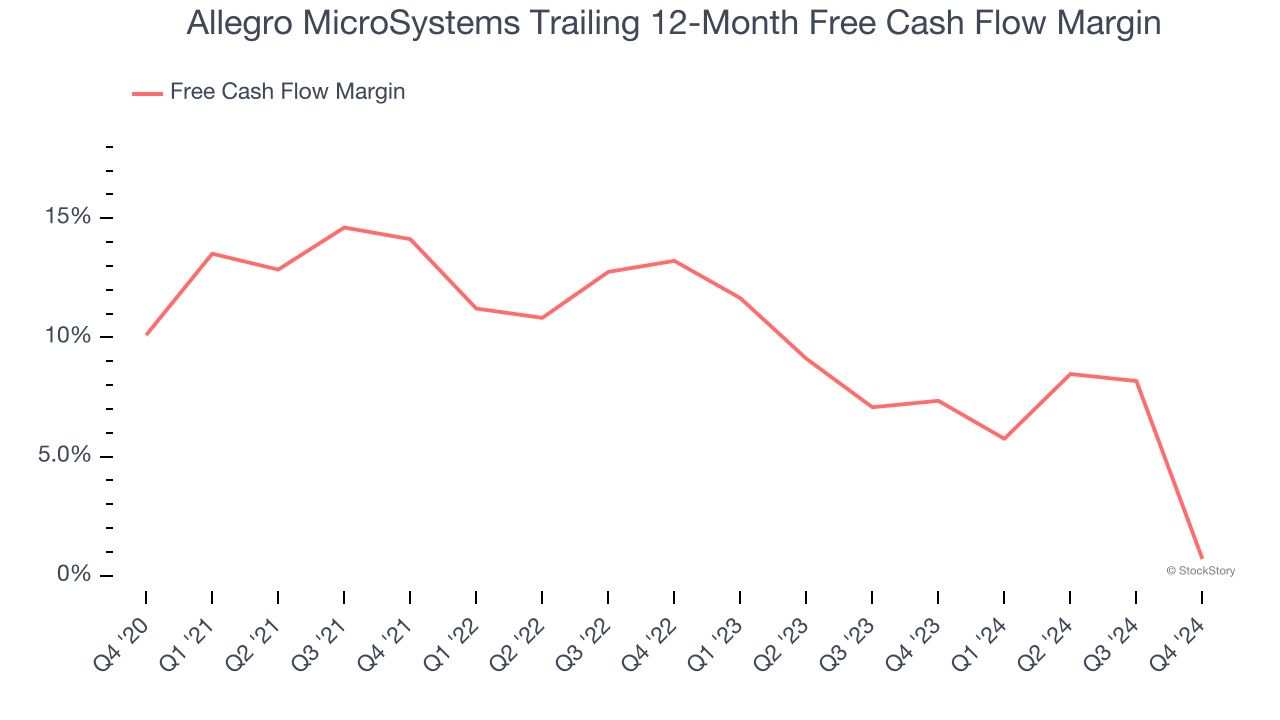

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Allegro MicroSystems’s margin dropped by 9.4 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business. Allegro MicroSystems’s free cash flow margin for the trailing 12 months was breakeven.

Final Judgment

We cheer for all companies solving complex technology issues, but in the case of Allegro MicroSystems, we’ll be cheering from the sidelines. With its shares topping the market in recent months, the stock trades at 49.6× forward price-to-earnings (or $24.11 per share). This valuation tells us a lot of optimism is priced in - we think there are better investment opportunities out there. Let us point you toward the Amazon and PayPal of Latin America.

Stocks We Like More Than Allegro MicroSystems

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.