Since April 2025, Yum! Brands has been in a holding pattern, posting a small return of 2.6% while floating around $148.72. The stock also fell short of the S&P 500’s 33.2% gain during that period.

Does this present a buying opportunity for YUM? Or is its underperformance reflective of its story and business quality? Find out in our full research report, it’s free for active Edge members.

Why Does Yum! Brands Spark Debate?

Spun off as an independent company from PepsiCo, Yum! Brands (NYSE:YUM) is a multinational corporation that owns KFC, Pizza Hut, Taco Bell, and The Habit Burger Grill.

Two Things to Like:

1. Restaurant Growth Signals an Offensive Strategy

The number of dining locations a restaurant chain operates is a critical driver of how quickly company-level sales can grow.

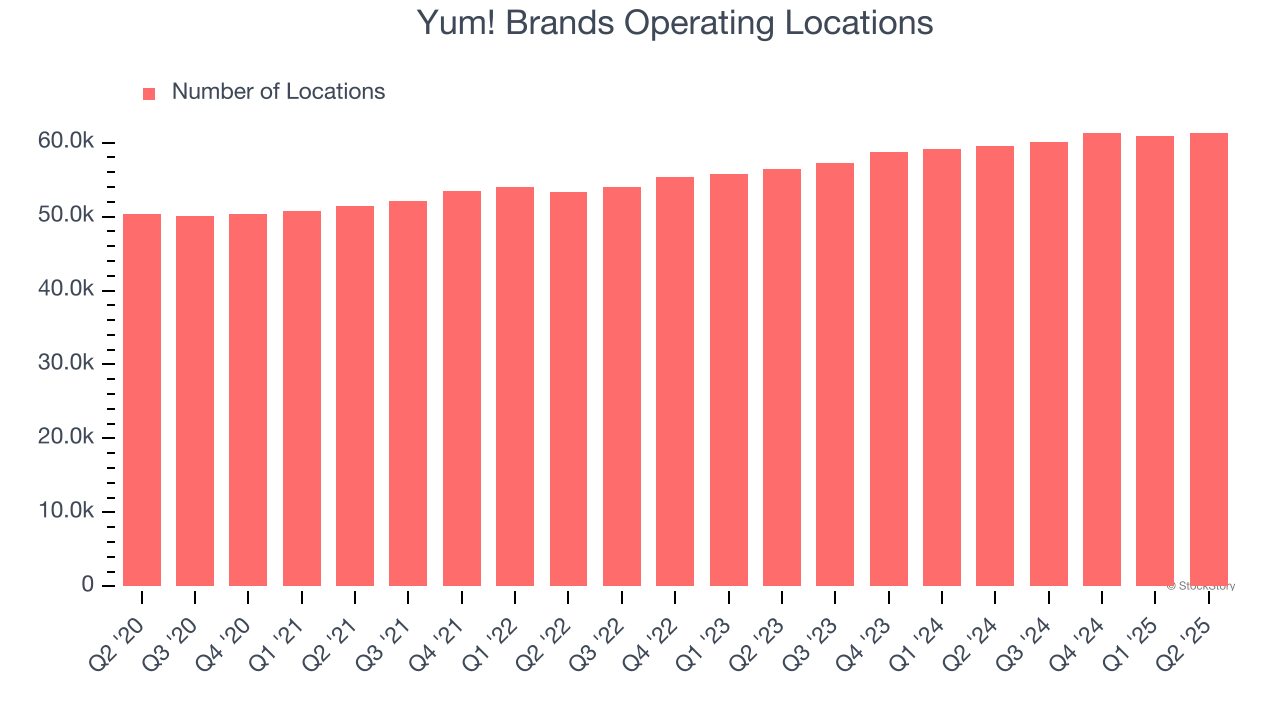

Yum! Brands sported 61,272 locations in the latest quarter. Over the last two years, it has opened new restaurants at a rapid clip by averaging 4.9% annual growth, among the fastest in the restaurant sector. Additionally, one dynamic making expansion more seamless is the company’s franchise model, where franchisees are primarily responsible for opening new restaurants while Yum! Brands provides support.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

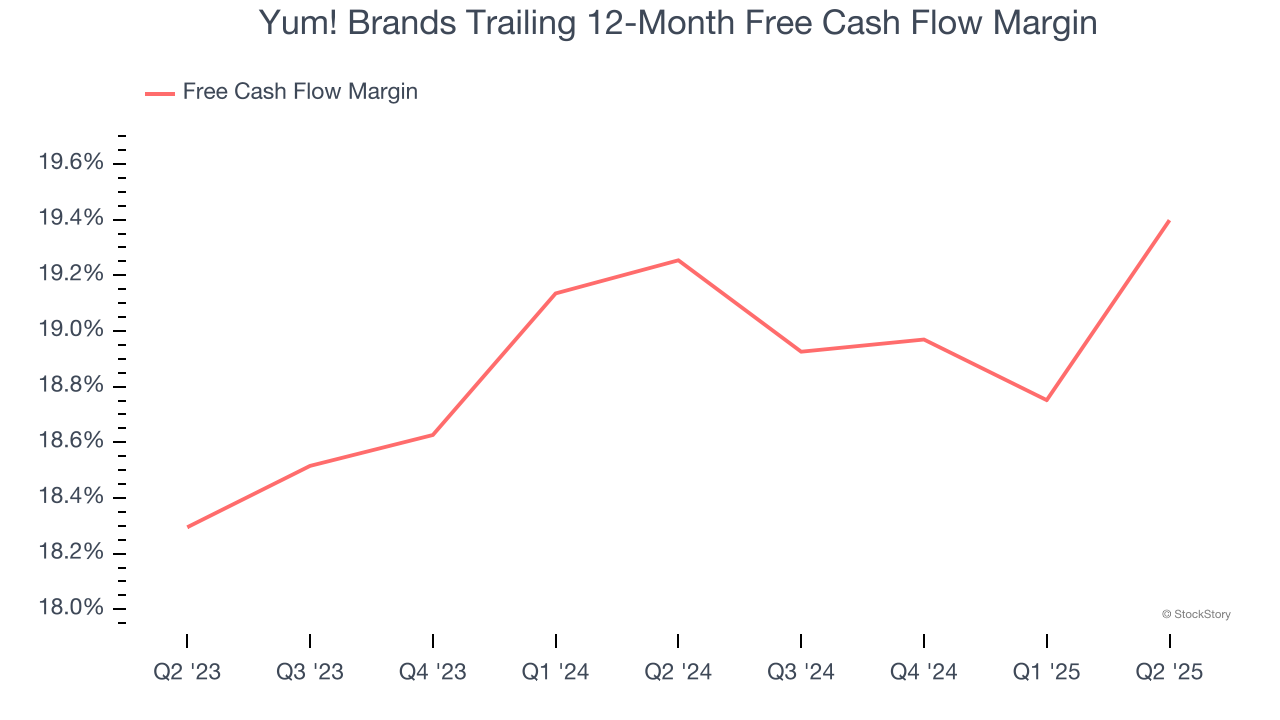

Yum! Brands has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the restaurant sector, averaging 19.3% over the last two years.

One Reason to be Careful:

Flat Same-Store Sales Indicate Weak Demand

Same-store sales is a key performance indicator used to measure organic growth at restaurants open for at least a year.

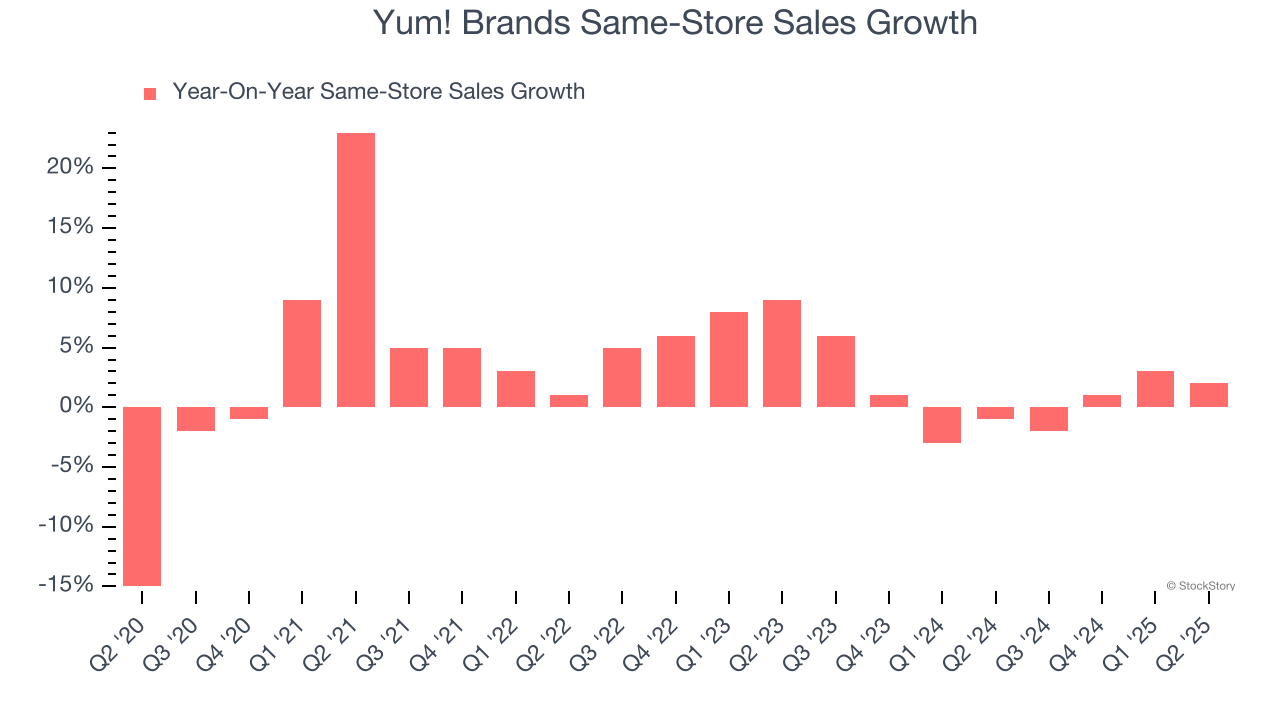

Yum! Brands’s demand within its existing dining locations has barely increased over the last two years as its same-store sales were flat.

Final Judgment

Yum! Brands’s positive characteristics outweigh the negatives. With its shares trailing the market in recent months, the stock trades at 23.4× forward P/E (or $148.72 per share). Is now the right time to buy? See for yourself in our full research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.