Over the past six months, Marqeta’s shares (currently trading at $4.18) have posted a disappointing 15% loss while the S&P 500 was down 4.1%. This may have investors wondering how to approach the situation.

Is now the time to buy Marqeta, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Even with the cheaper entry price, we're swiping left on Marqeta for now. Here are three reasons why MQ doesn't excite us and a stock we'd rather own.

Why Is Marqeta Not Exciting?

Founded by CEO Jason Gardner in 2009, Marqeta (NASDAQ:MQ) is an innovative card issuer that provides companies with the ability to issue and process virtual, physical, and tokenized credit and debit cards.

1. Long-Term Revenue Growth Flatter Than a Pancake

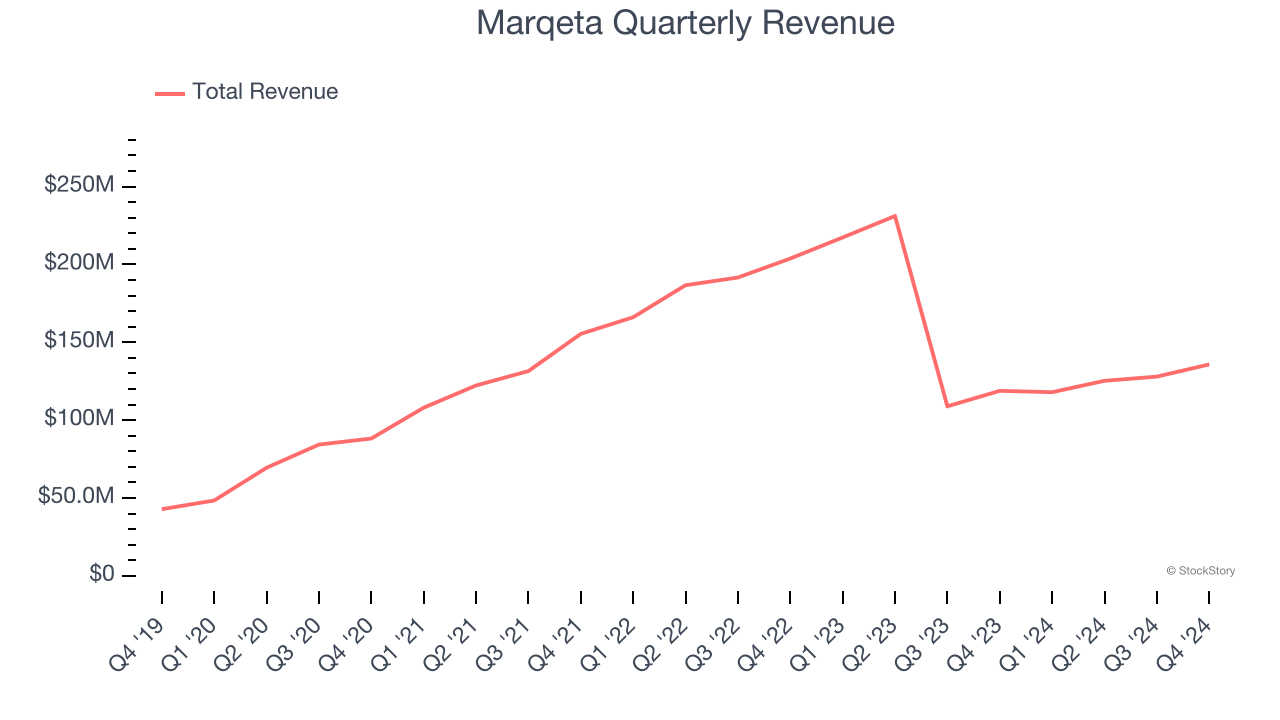

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Marqeta struggled to consistently increase demand as its $507 million of sales for the trailing 12 months was close to its revenue three years ago. This wasn’t a great result and signals it’s a lower quality business.

2. Long Payback Periods Delay Returns

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Marqeta’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a competitive market and must continue investing to grow.

3. Operating Losses Sound the Alarms

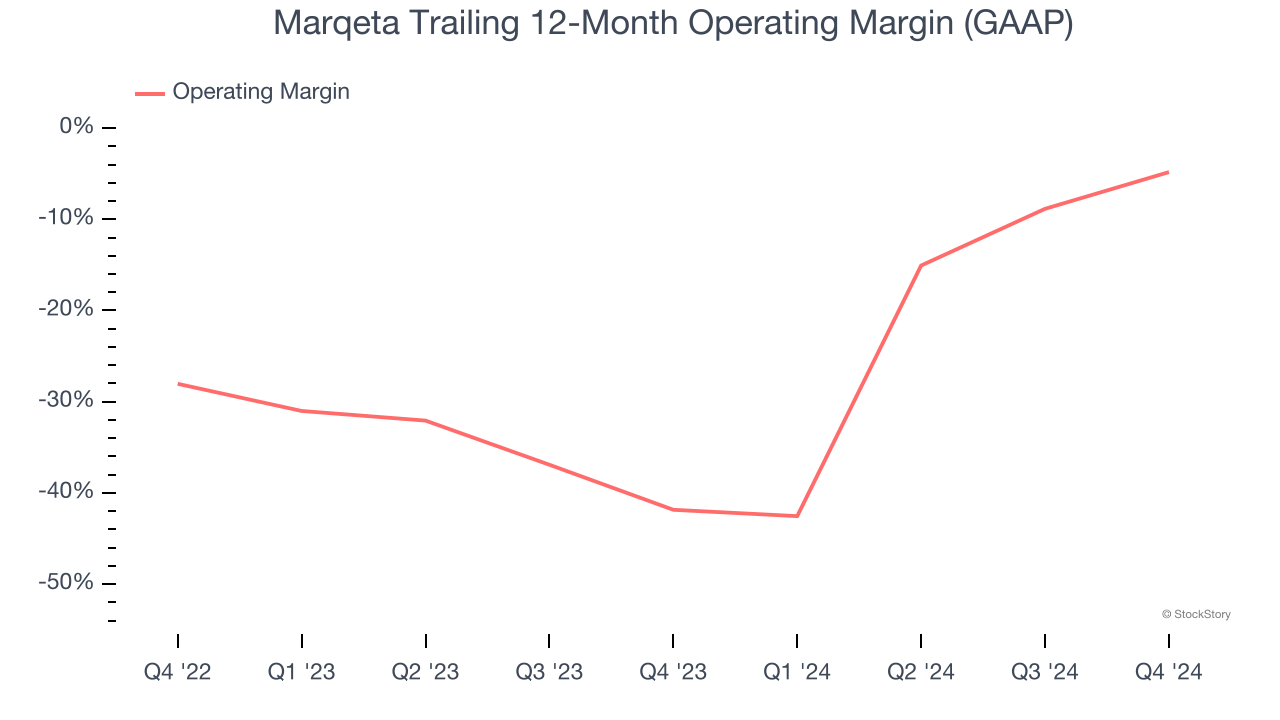

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Marqeta’s expensive cost structure has contributed to an average operating margin of negative 4.8% over the last year. Unprofitable software companies require extra attention because they spend heaps of money to capture market share. As seen in its historically underwhelming revenue performance, this strategy hasn’t worked so far, and it’s unclear what would happen if Marqeta reeled back its investments. Wall Street seems to be optimistic about its growth, but we have some doubts.

Final Judgment

Marqeta isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 3.6× forward price-to-sales (or $4.18 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are superior stocks to buy right now. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Like More Than Marqeta

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.