Payroll and HR services provider Automatic Data Processing (NASDAQ:ADP) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 5.7% year on year to $5.55 billion. Its non-GAAP profit of $3.06 per share was 2.9% above analysts’ consensus estimates.

Is now the time to buy ADP? Find out by accessing our full research report, it’s free.

ADP (ADP) Q1 CY2025 Highlights:

- Revenue: $5.55 billion vs analyst estimates of $5.49 billion (5.7% year-on-year growth, 1.1% beat)

- Adjusted EPS: $3.06 vs analyst estimates of $2.97 (2.9% beat)

- Raising full year guidance for adjusted EBIT margin and adjusted diluted EPS growth

- Operating Margin: 29.4%, in line with the same quarter last year

- Market Capitalization: $120.3 billion

Company Overview

Processing one out of every six paychecks in the United States, ADP (NASDAQ:ADP) provides cloud-based human capital management solutions that help businesses manage payroll, benefits, talent acquisition, and HR administration.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $20.2 billion in revenue over the past 12 months, ADP is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices.

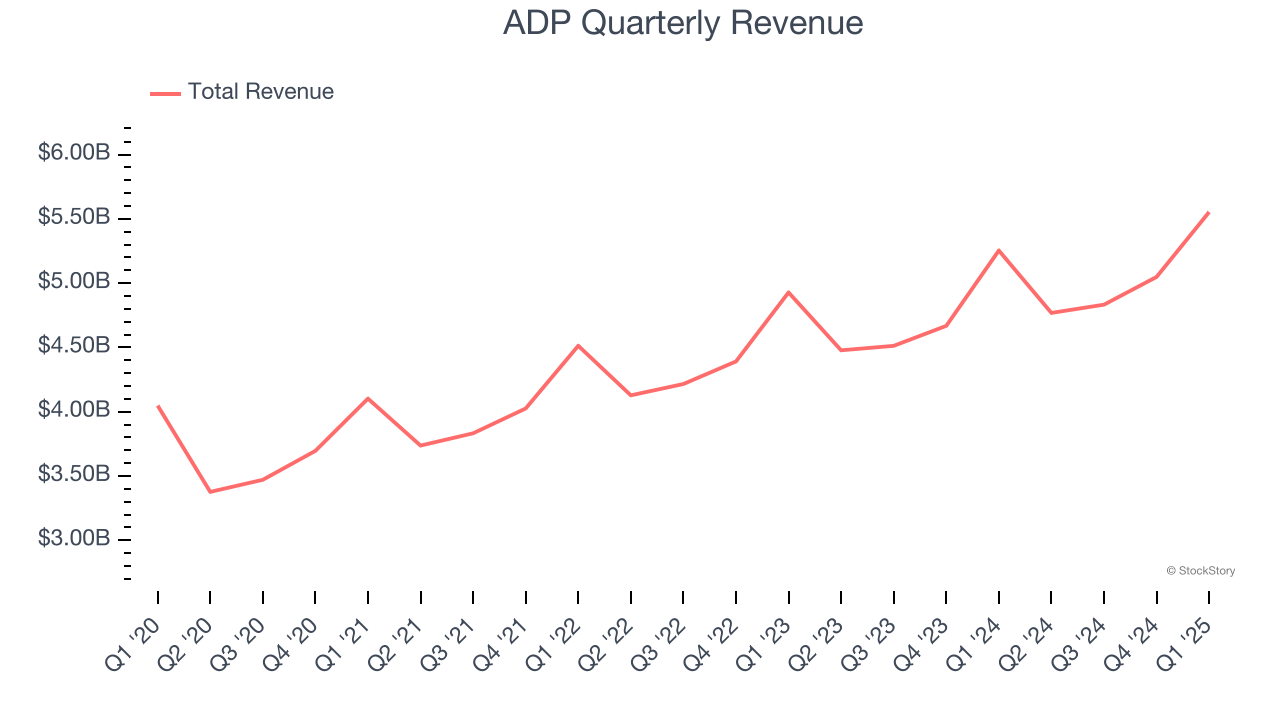

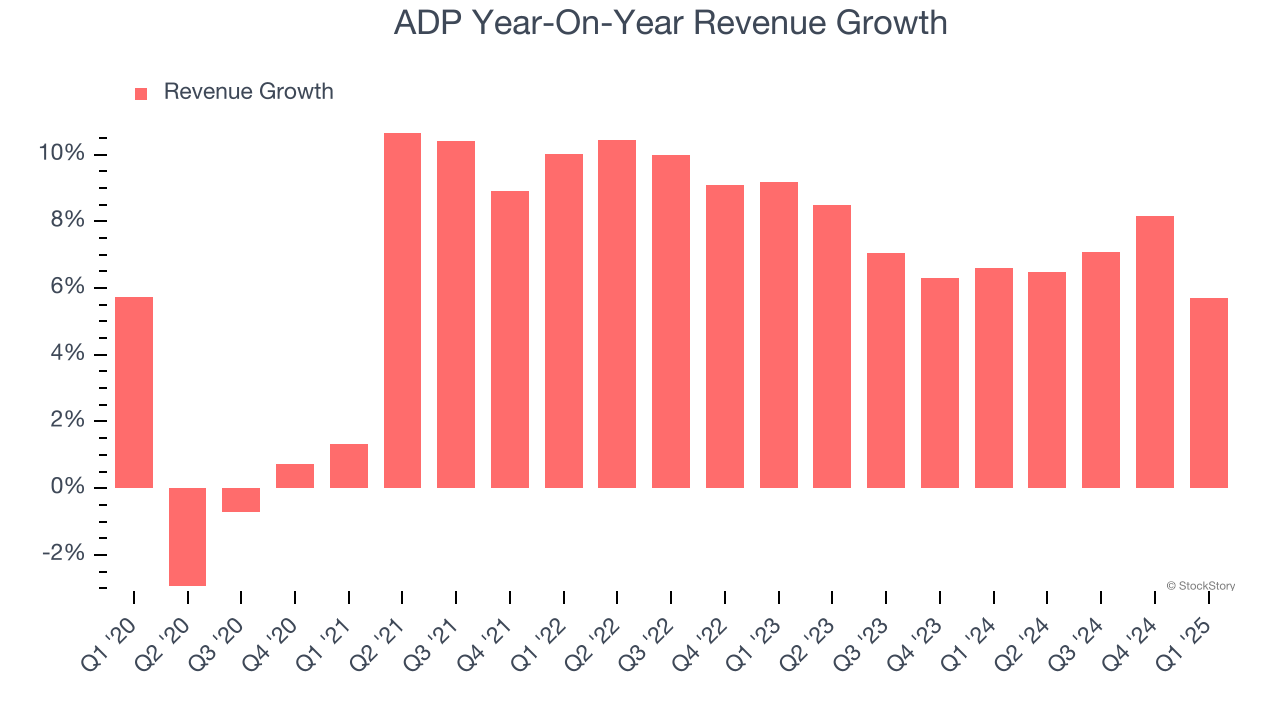

As you can see below, ADP’s sales grew at a decent 6.6% compounded annual growth rate over the last five years. This shows its offerings generated slightly more demand than the average business services company, a helpful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. ADP’s annualized revenue growth of 7% over the last two years aligns with its five-year trend, suggesting its demand was stable.

This quarter, ADP reported year-on-year revenue growth of 5.7%, and its $5.55 billion of revenue exceeded Wall Street’s estimates by 1.1%.

Looking ahead, sell-side analysts expect revenue to grow 5.5% over the next 12 months, similar to its two-year rate. We still think its growth trajectory is satisfactory given its scale and suggests the market is forecasting success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

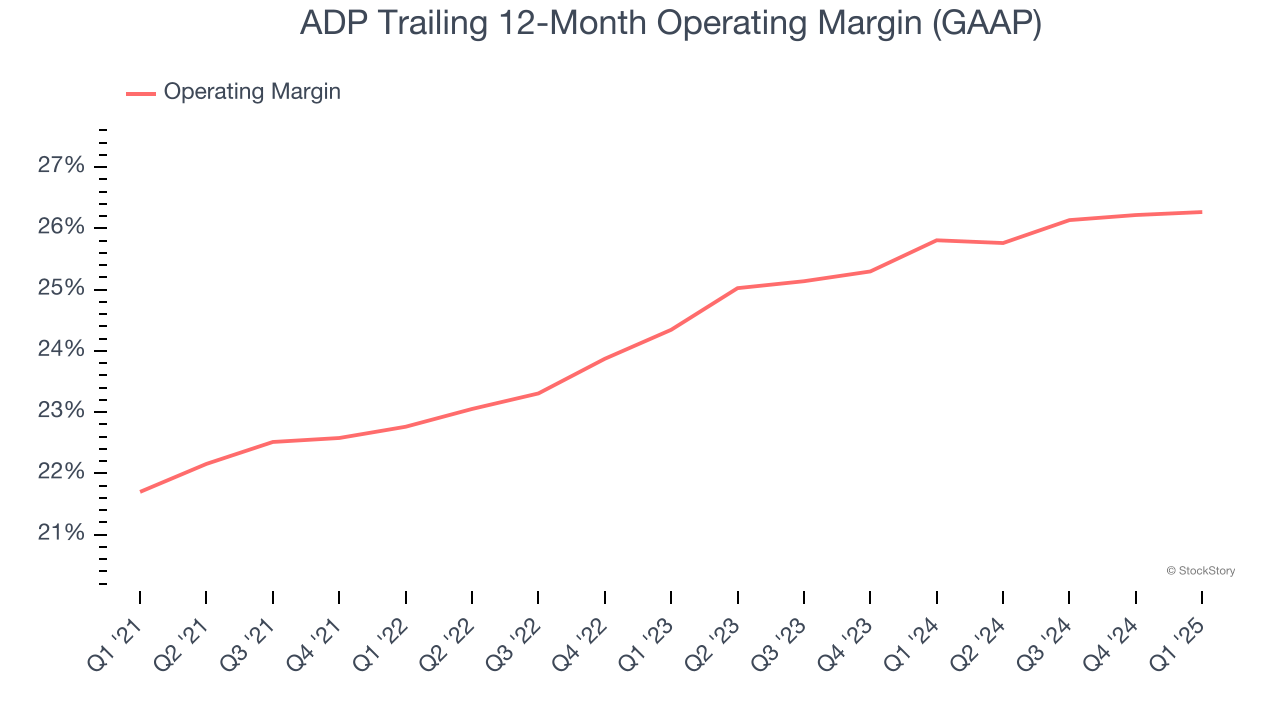

ADP has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 24.4%.

Analyzing the trend in its profitability, ADP’s operating margin rose by 4.6 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, ADP generated an operating profit margin of 29.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

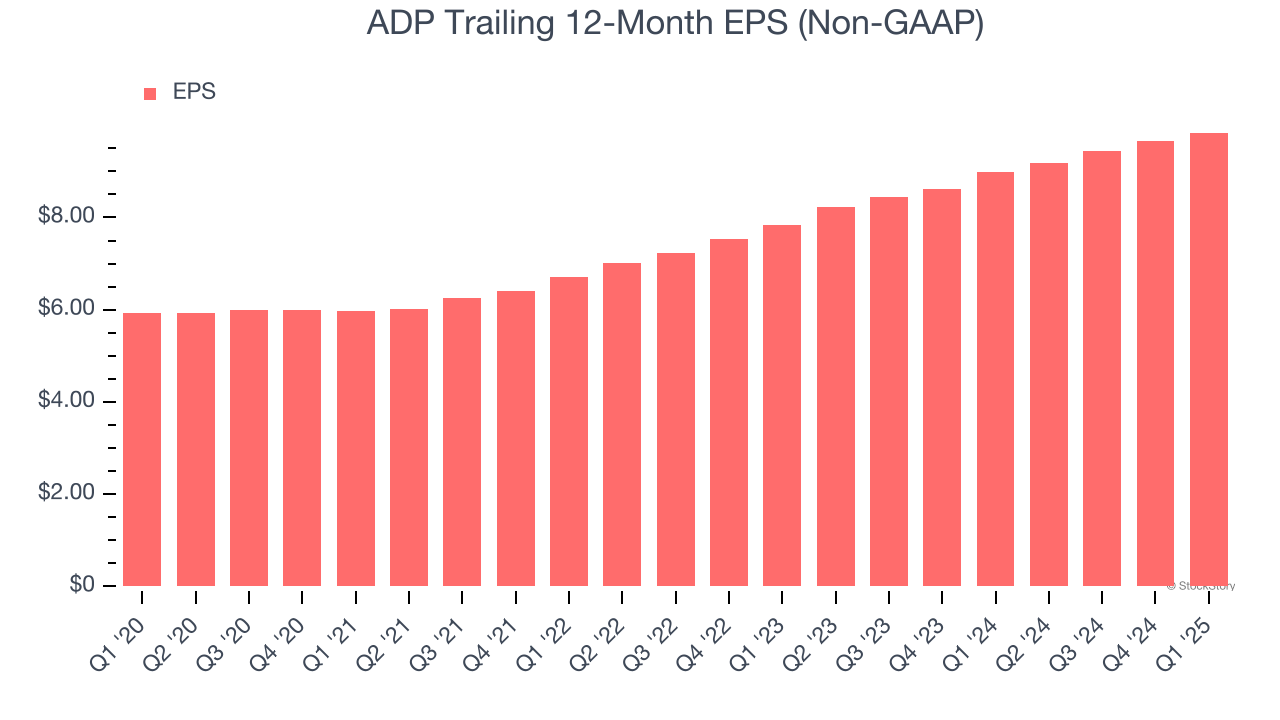

ADP’s EPS grew at a remarkable 10.7% compounded annual growth rate over the last five years, higher than its 6.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

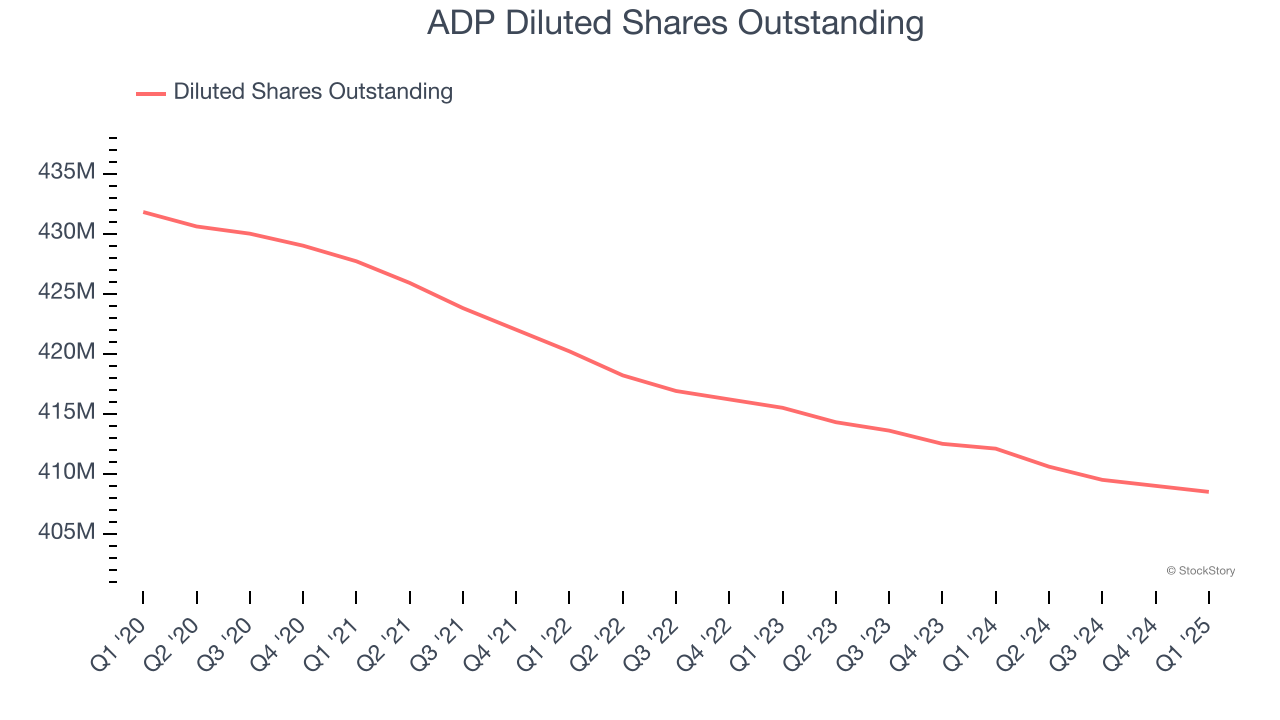

Diving into the nuances of ADP’s earnings can give us a better understanding of its performance. As we mentioned earlier, ADP’s operating margin was flat this quarter but expanded by 4.6 percentage points over the last five years. On top of that, its share count shrank by 5.4%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q1, ADP reported EPS at $3.06, up from $2.88 in the same quarter last year. This print beat analysts’ estimates by 2.9%. Over the next 12 months, Wall Street expects ADP’s full-year EPS of $9.84 to grow 7.8%.

Key Takeaways from ADP’s Q1 Results

It was good to see ADP narrowly top analysts’ revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. Adding to the good news, the company is raising its full-year guidance for adjusted EBIT margin and adjusted diluted EPS growth. Overall, this quarter had some key positives. The stock remained flat at $294.50 immediately after reporting.

So do we think ADP is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.