Aerospace and defense company Howmet (NYSE:HWM) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 6.5% year on year to $1.94 billion. The company expects next quarter’s revenue to be around $1.99 billion, close to analysts’ estimates. Its non-GAAP profit of $0.86 per share was 10.7% above analysts’ consensus estimates.

Is now the time to buy Howmet? Find out by accessing our full research report, it’s free.

Howmet (HWM) Q1 CY2025 Highlights:

- Revenue: $1.94 billion vs analyst estimates of $1.94 billion (6.5% year-on-year growth, in line)

- Adjusted EPS: $0.86 vs analyst estimates of $0.78 (10.7% beat)

- Adjusted EBITDA: $560 million vs analyst estimates of $524.4 million (28.8% margin, 6.8% beat)

- The company reconfirmed its revenue guidance for the full year of $8.03 billion at the midpoint

- Management raised its full-year Adjusted EPS guidance to $3.40 at the midpoint, a 7.3% increase

- EBITDA guidance for the full year is $2.25 billion at the midpoint, above analyst estimates of $2.17 billion

- Operating Margin: 25.4%, up from 20.2% in the same quarter last year

- Free Cash Flow Margin: 6.9%, up from 5.2% in the same quarter last year

- Market Capitalization: $56.05 billion

Howmet Aerospace Executive Chairman and Chief Executive Officer John Plant said, “The Howmet team delivered a solid start to 2025, setting quarterly records in revenue, Adjusted EBITDA*, Adjusted EBITDA margin*, and Adjusted Earnings Per Share* while exceeding all aspects of our baseline guidance. Margin progression within the Fastening Systems and Engineered Structures segments was particularly noteworthy. Free cash flow was healthy at $134 million, up from $95 million in the prior year, and marked the eighth consecutive quarter of positive free cash flow generation.”

Company Overview

Inventing the first forged aluminum truck wheel, Howmet (NYSE:HWM) specializes in lightweight metals engineering and manufacturing multi-material components used in vehicles.

Sales Growth

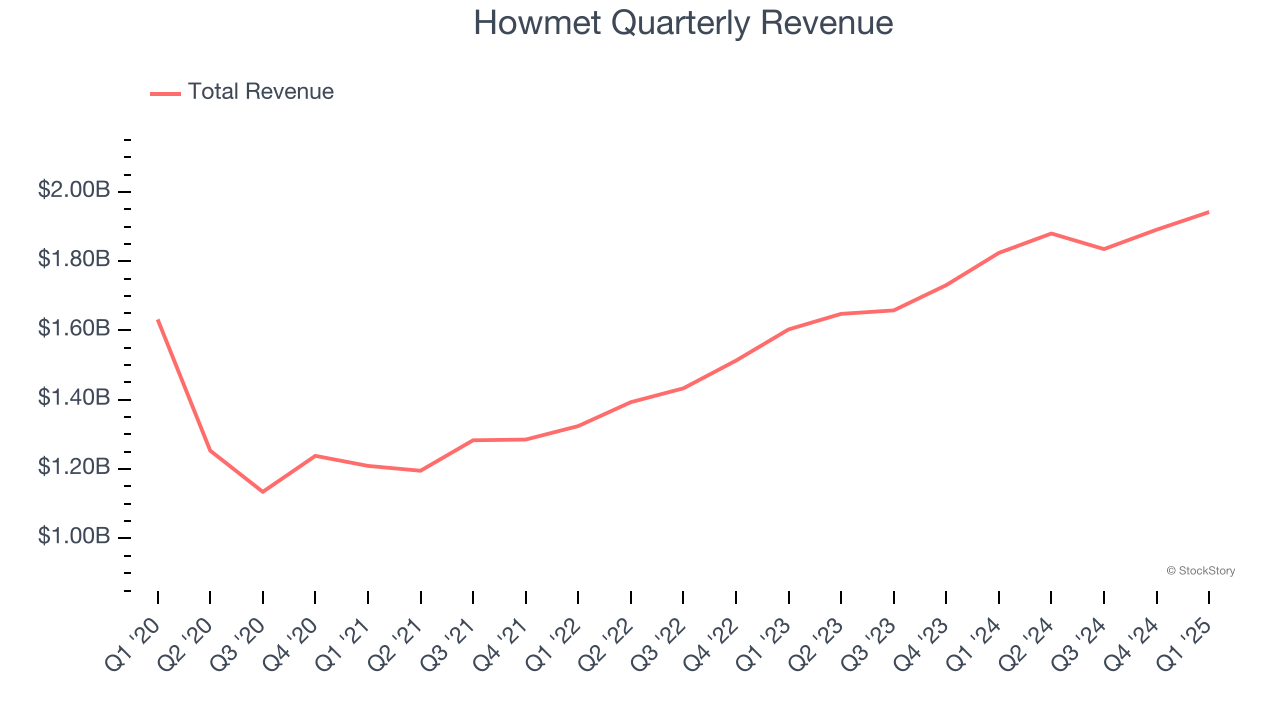

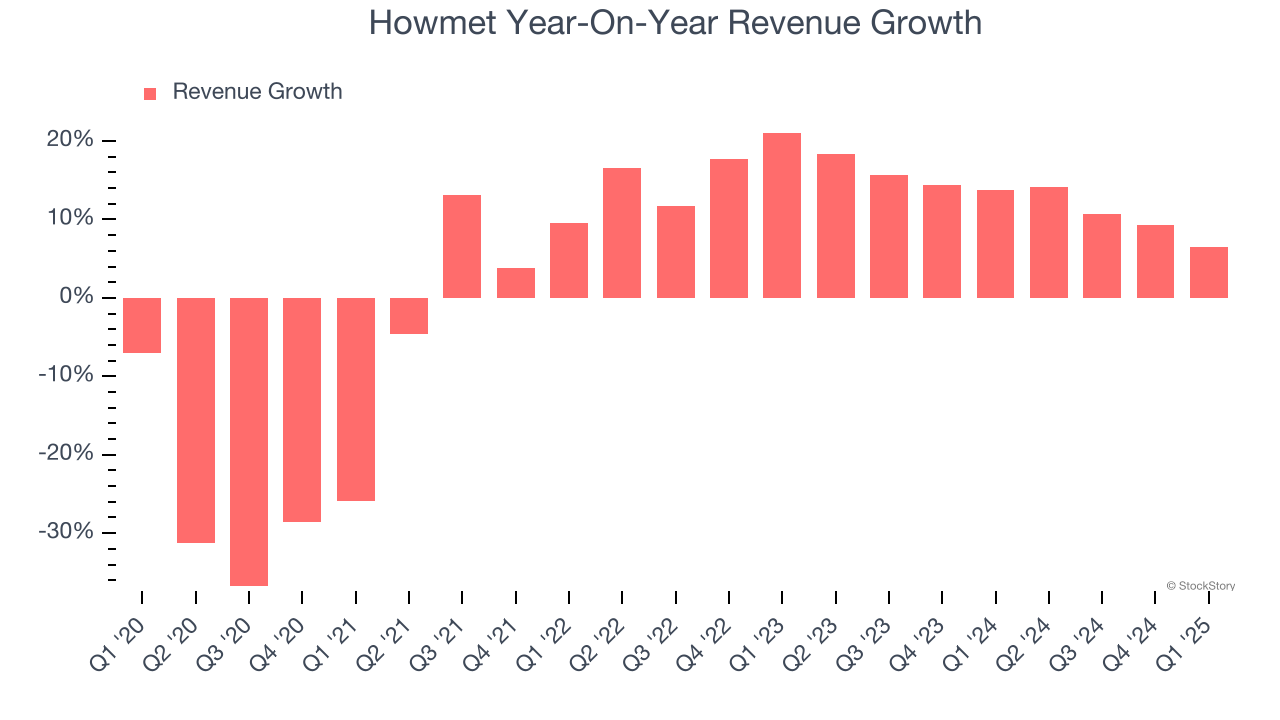

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Howmet’s sales grew at a sluggish 1.6% compounded annual growth rate over the last five years. This wasn’t a great result, but there are still things to like about Howmet.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Howmet’s annualized revenue growth of 12.7% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Engine products and Fastening systems, which are 51.3% and 21.2% of revenue. Over the last two years, Howmet’s Engine products revenue (aircraft engines, industrial turbines) averaged 16.1% year-on-year growth while its Fastening systems revenue (connector products and tools) averaged 17.4% growth.

This quarter, Howmet grew its revenue by 6.5% year on year, and its $1.94 billion of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 5.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.1% over the next 12 months, a deceleration versus the last two years. Still, this projection is commendable and implies the market is forecasting success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

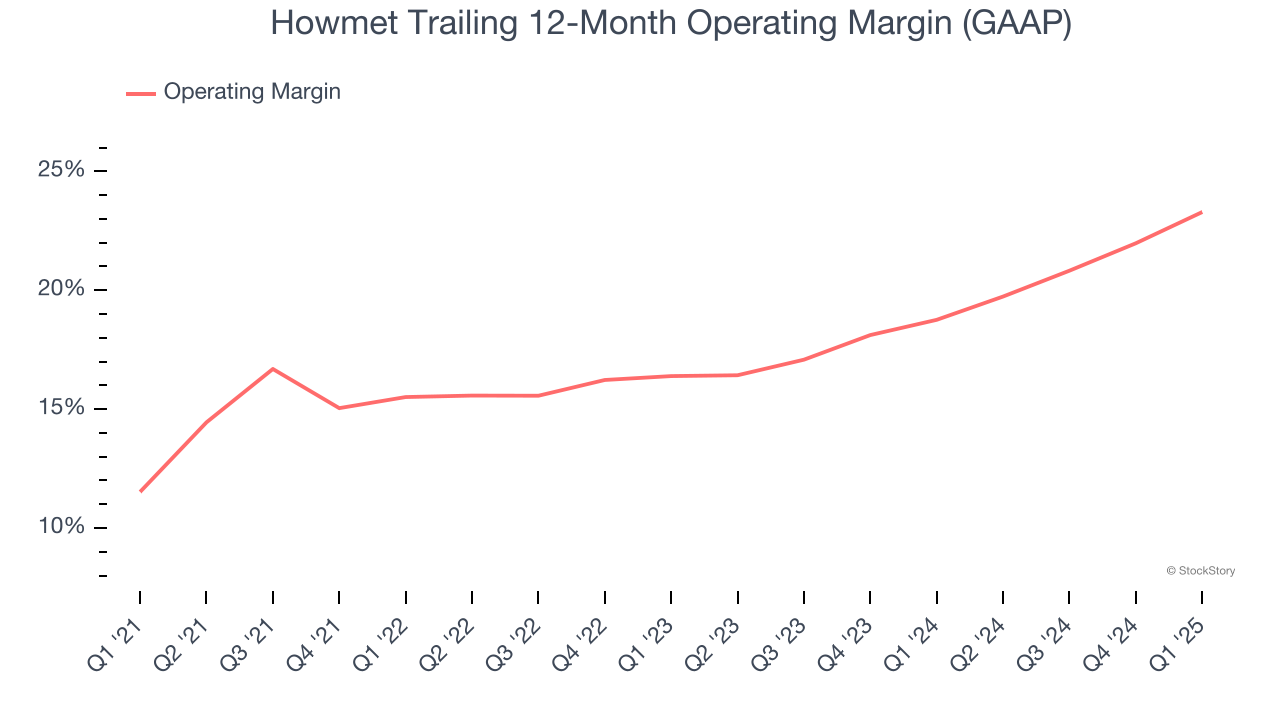

Operating Margin

Howmet has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 17.7%.

Looking at the trend in its profitability, Howmet’s operating margin rose by 11.8 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q1, Howmet generated an operating profit margin of 25.4%, up 5.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

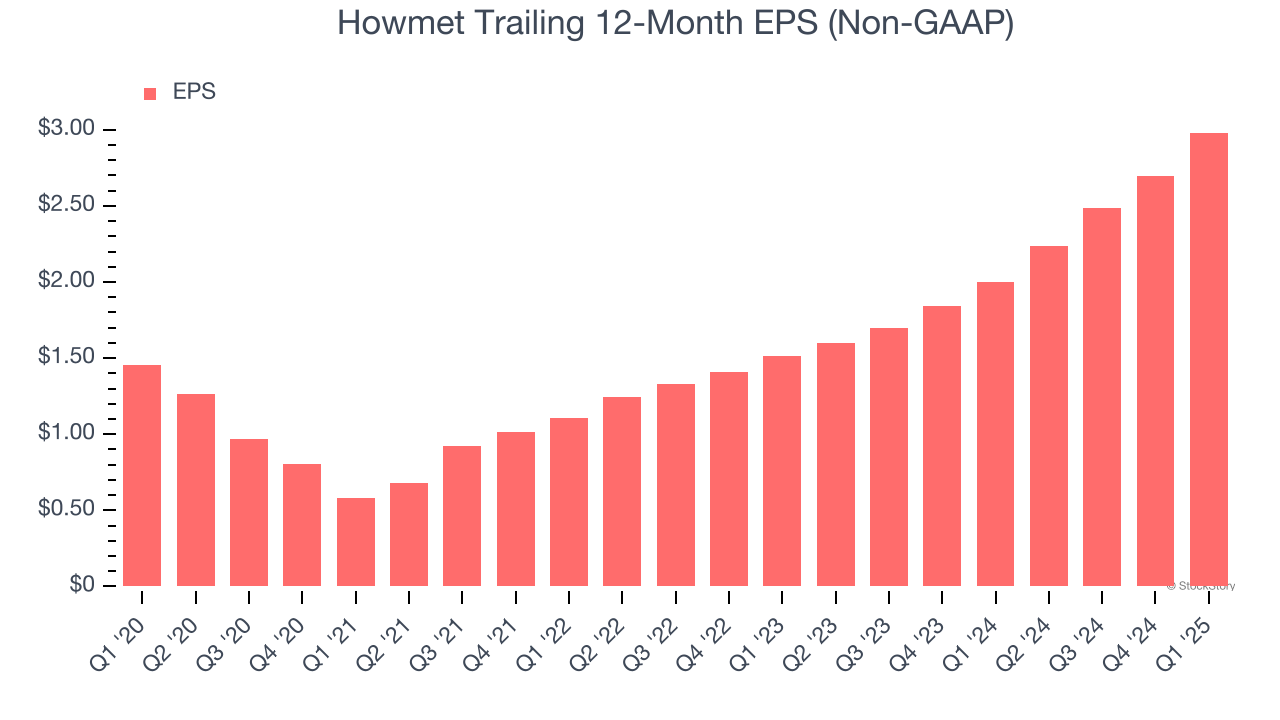

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Howmet’s EPS grew at a spectacular 15.5% compounded annual growth rate over the last five years, higher than its 1.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

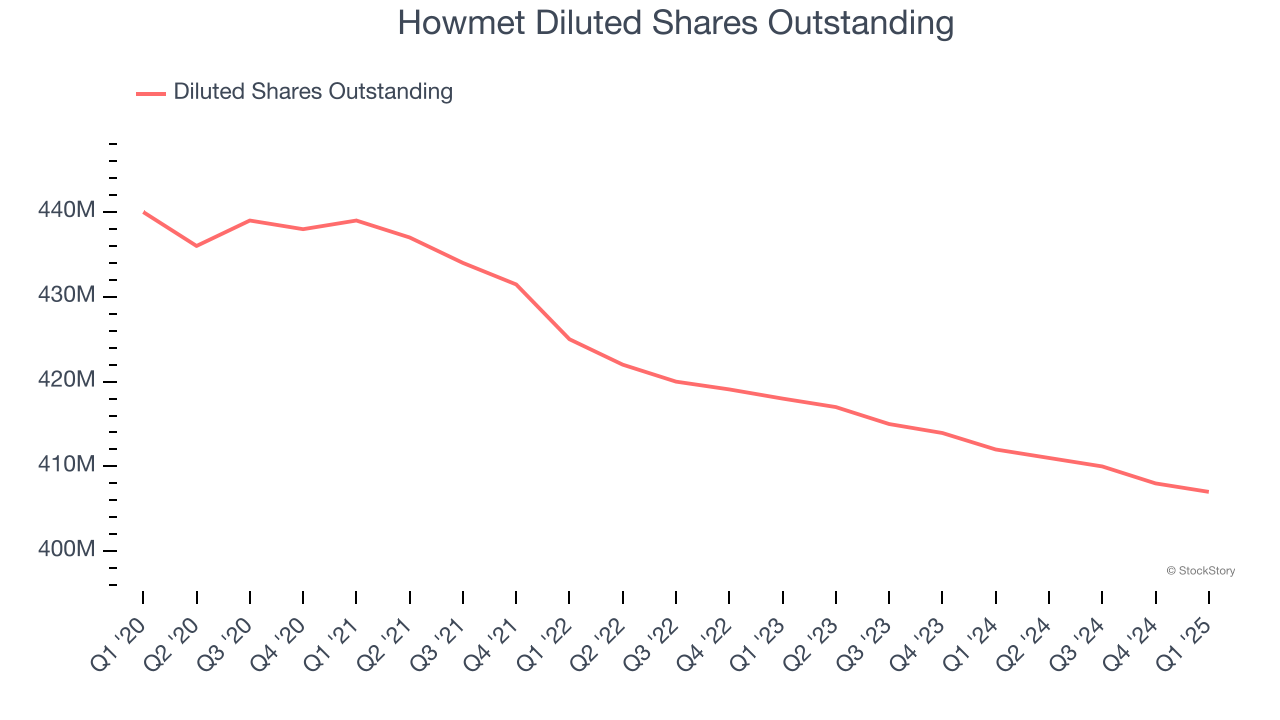

Diving into Howmet’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Howmet’s operating margin expanded by 11.8 percentage points over the last five years. On top of that, its share count shrank by 7.5%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Howmet, its two-year annual EPS growth of 40.3% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q1, Howmet reported EPS at $0.86, up from $0.58 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Howmet’s full-year EPS of $2.98 to grow 13.6%.

Key Takeaways from Howmet’s Q1 Results

Despite in-line revenue, Howmet beat EBITDA and EPS expectations. We were also impressed by Howmet’s optimistic full-year EBITDA guidance, which beat analysts’ expectations. Full-year EPS guidance was also raised. On the other hand, its Engine products revenue missed and its full-year revenue guidance fell slightly short of Wall Street’s estimates. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 4.7% to $145.03 immediately following the results.

Indeed, Howmet had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.