The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how health insurance providers stocks fared in Q1, starting with Cencora (NYSE:COR).

Upfront premiums collected by health insurers lead to reliable revenue, but profitability ultimately depends on accurate risk assessments and the ability to control medical costs. Health insurers are also highly sensitive to regulatory changes and economic conditions such as unemployment. Going forward, the industry faces tailwinds from an aging population, increasing demand for personalized healthcare services, and advancements in data analytics to improve cost management. However, continued regulatory scrutiny on pricing practices, the potential for government-led reforms such as expanded public healthcare options, and inflation in medical costs could add volatility to margins. One big debate among investors is the long-term impact of AI and whether it will help underwriting, fraud detection, and claims processing or whether it may wade into ethical grey areas like reinforcing biases and widening disparities in medical care.

The 12 health insurance providers stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 3.3% while next quarter’s revenue guidance was in line.

While some health insurance providers stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.8% since the latest earnings results.

Cencora (NYSE:COR)

Formerly known as AmerisourceBergen until its 2023 rebranding, Cencora (NYSE:COR) is a global pharmaceutical distribution company that connects manufacturers with healthcare providers while offering logistics, data analytics, and consulting services.

Cencora reported revenues of $75.45 billion, up 10.3% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a decent beat of analysts’ EPS estimates.

“Cencora’s second quarter results reflect the strength of our value proposition as a healthcare services provider and the important role we play in the supply chain, driven by our pharmaceutical distribution footprint and complementary end-to-end services and solutions,” said Robert P. Mauch, President and Chief Executive Officer of Cencora.

Interestingly, the stock is up 3.2% since reporting and currently trades at $299.85.

Is now the time to buy Cencora? Access our full analysis of the earnings results here, it’s free.

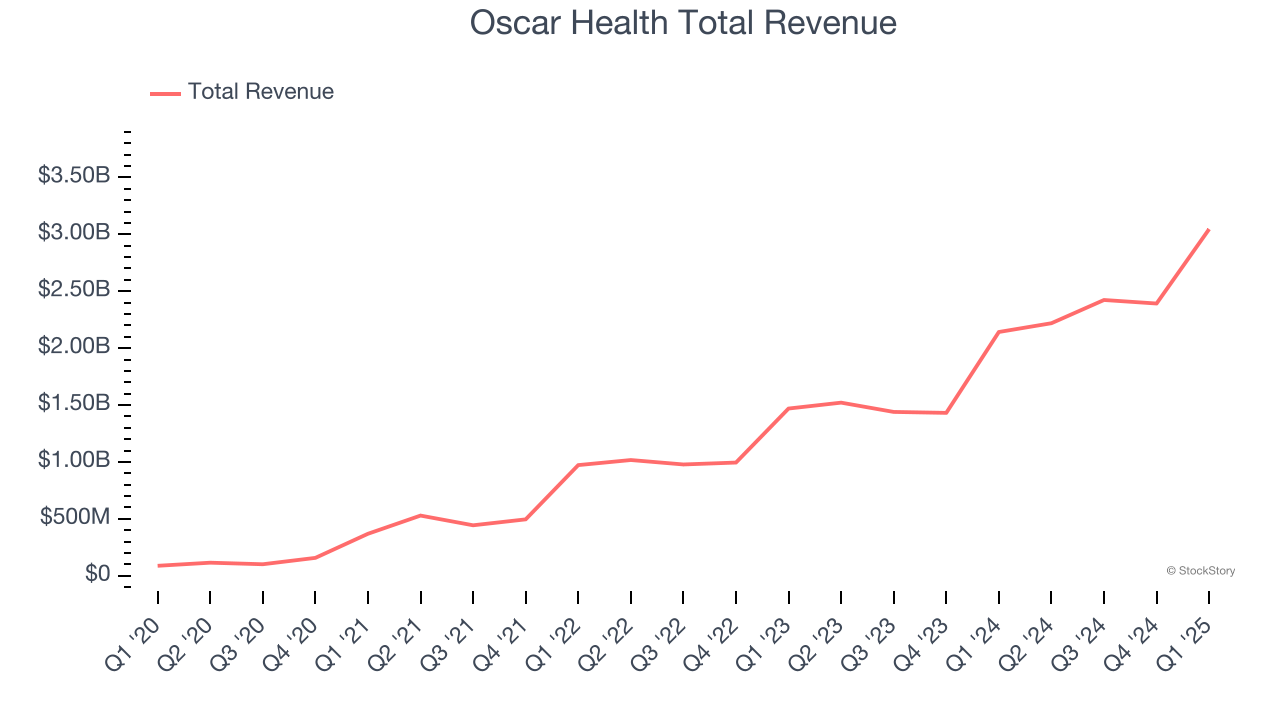

Best Q1: Oscar Health (NYSE:OSCR)

Founded in 2012 to simplify the notoriously complex American healthcare system, Oscar Health (NYSE:OSCR) is a technology-focused health insurance company that offers individual and small group health plans through its cloud-native platform.

Oscar Health reported revenues of $3.05 billion, up 42.2% year on year, outperforming analysts’ expectations by 6.9%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 64.7% since reporting. It currently trades at $21.56.

Is now the time to buy Oscar Health? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: UnitedHealth (NYSE:UNH)

With over 100 million people served across its various businesses and a workforce of more than 400,000, UnitedHealth Group (NYSE:UNH) operates a health insurance business and Optum, a healthcare services division that provides everything from pharmacy benefits to primary care.

UnitedHealth reported revenues of $109.6 billion, up 9.8% year on year, falling short of analysts’ expectations by 1.7%. It was a softer quarter as it posted a significant miss of analysts’ full-year EPS guidance estimates.

UnitedHealth delivered the weakest performance against analyst estimates in the group. The company added 395,000 customers to reach a total of 54.12 million. As expected, the stock is down 46.8% since the results and currently trades at $311.42.

Read our full analysis of UnitedHealth’s results here.

Cigna (NYSE:CI)

With roots dating back to 1792 and serving millions of customers across the globe, The Cigna Group (NYSE:CI) provides healthcare services through its Evernorth Health Services and Cigna Healthcare segments, offering pharmacy benefits, specialty care, and medical plans.

Cigna reported revenues of $65.5 billion, up 14.4% year on year. This result topped analysts’ expectations by 8.4%. Taking a step back, it was a satisfactory quarter as it also produced a decent beat of analysts’ EPS estimates but a significant miss of analysts’ customer base estimates.

Cigna pulled off the biggest analyst estimates beat among its peers. The company lost 1.14 million customers and ended up with a total of 16.36 million. The stock is down 1.3% since reporting and currently trades at $330.40.

Read our full, actionable report on Cigna here, it’s free.

CVS Health (NYSE:CVS)

With over 9,000 retail pharmacy locations serving as neighborhood health destinations across America, CVS Health (NYSE:CVS) operates retail pharmacies, provides pharmacy benefit management services, and offers health insurance through its Aetna subsidiary.

CVS Health reported revenues of $94.59 billion, up 7% year on year. This print surpassed analysts’ expectations by 1.5%. Overall, it was an exceptional quarter as it also logged an impressive beat of analysts’ same-store sales estimates and a solid beat of analysts’ EPS estimates.

CVS Health had the slowest revenue growth among its peers. The stock is up 3.4% since reporting and currently trades at $68.95.

Read our full, actionable report on CVS Health here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.