McDonald's currently trades at $297.70 per share and has shown little upside over the past six months, posting a middling return of 1.8%.

Given the underwhelming price action, is now a good time to buy MCD? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free.

Why Does McDonald's Spark Debate?

With nicknames spanning Mickey D's in the U.S. to Makku in Japan, McDonald’s (NYSE:MCD) is a fast-food behemoth known for its convenience and broken ice cream machines.

Two Positive Attributes:

1. Solid Same-Store Sales Suggest Increasing Demand

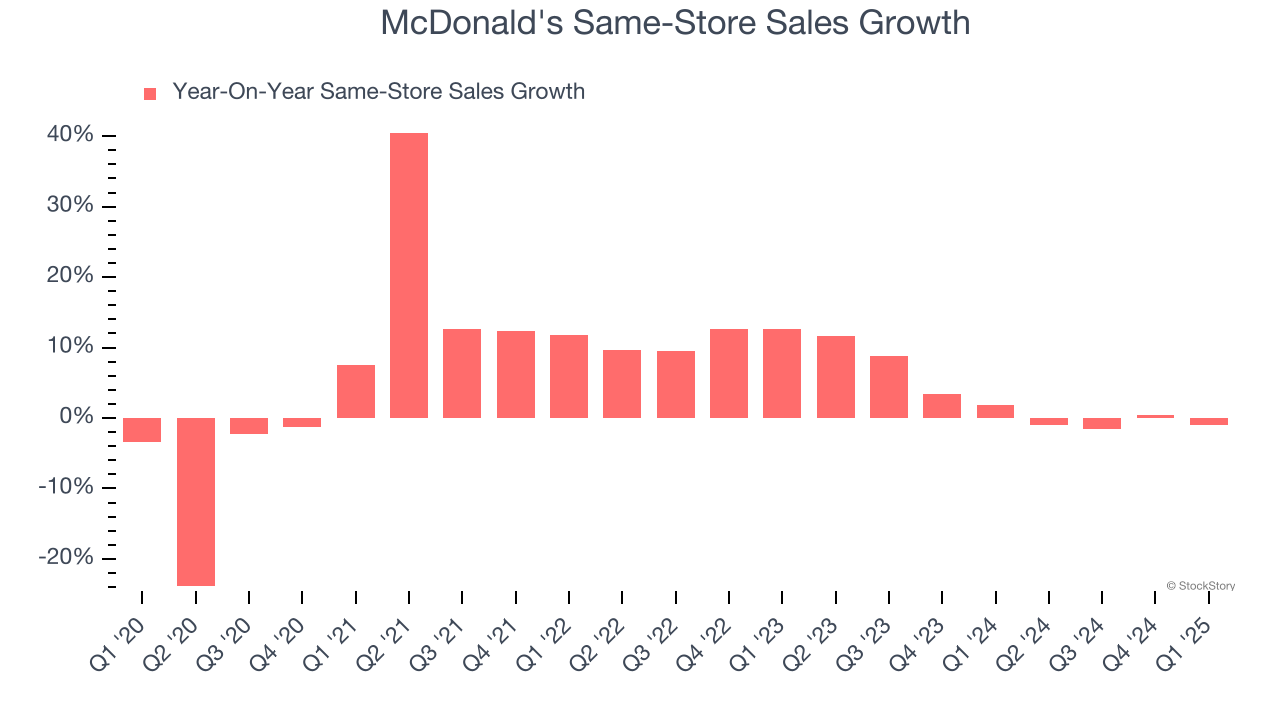

Same-store sales is an industry measure of whether revenue is growing at existing restaurants, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

McDonald’s demand has been healthy for a restaurant chain over the last two years. On average, the company has grown its same-store sales by a robust 2.8% per year.

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

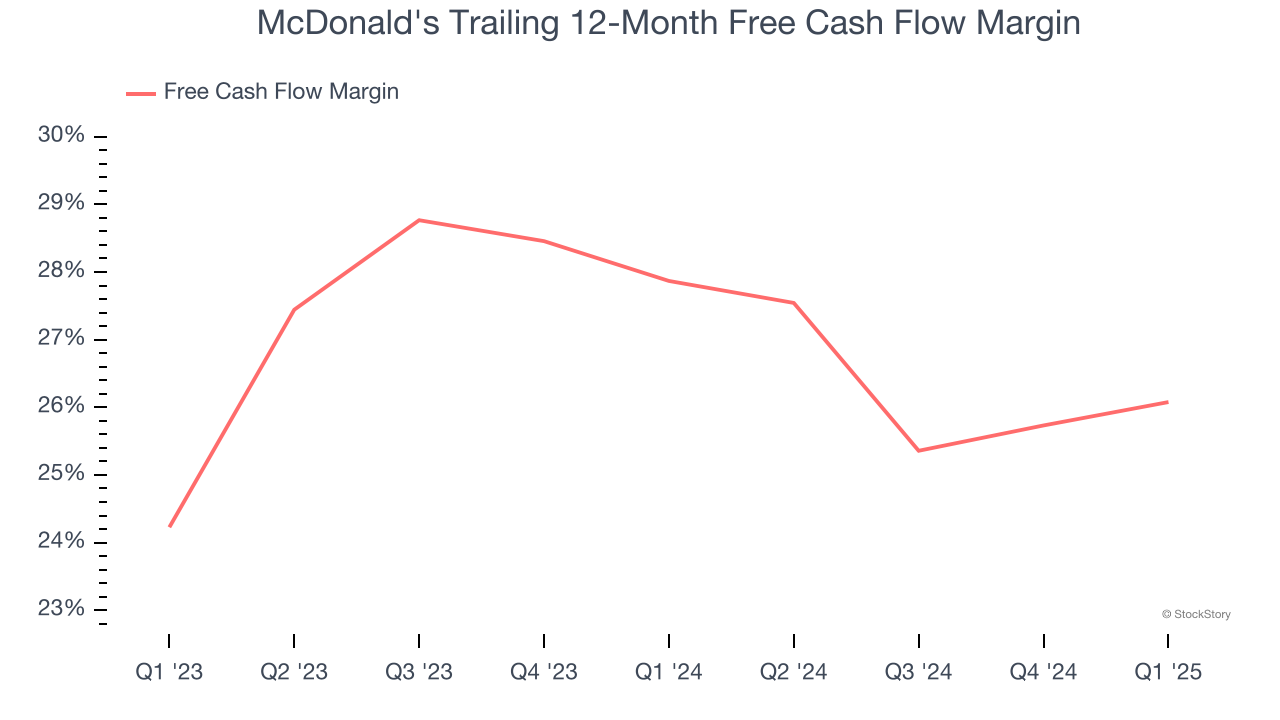

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

McDonald's has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the restaurant sector, averaging 27% over the last two years.

One Reason to be Careful:

Long-Term Revenue Growth Disappoints

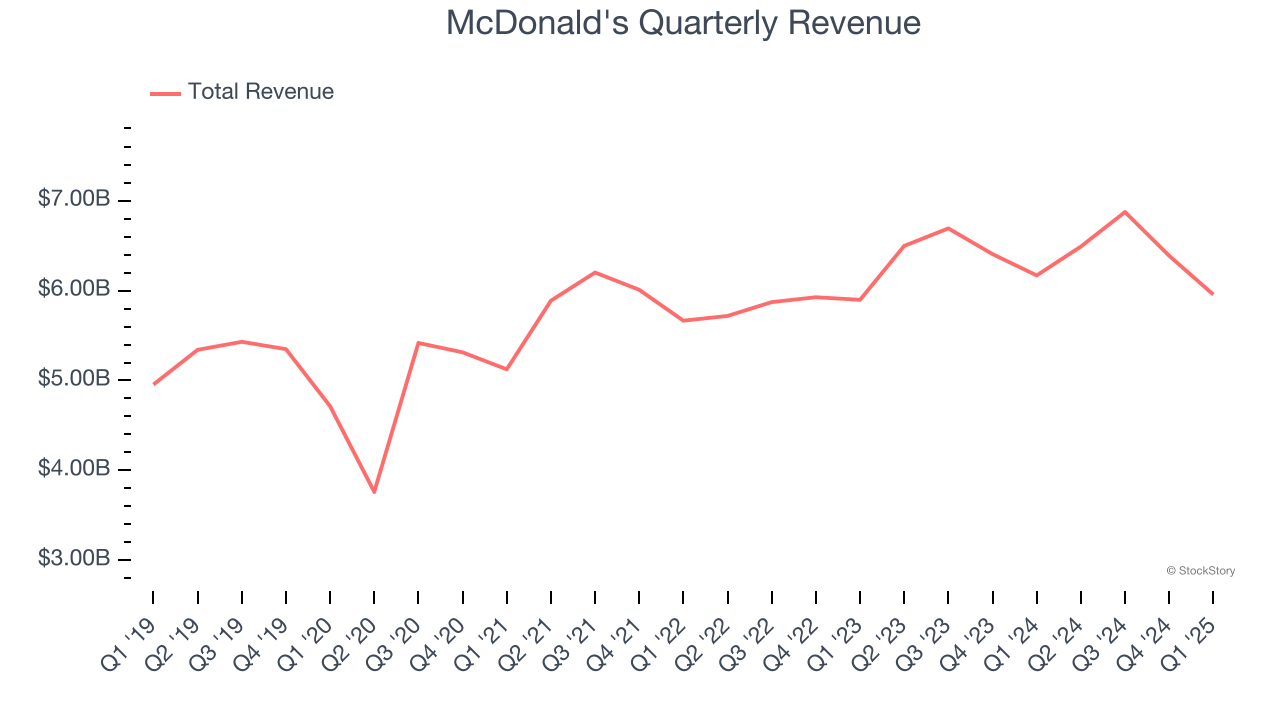

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, McDonald’s sales grew at a sluggish 3.6% compounded annual growth rate over the last six years. This wasn’t a great result compared to the rest of the restaurant sector, but there are still things to like about McDonald's.

Final Judgment

McDonald's has huge potential even though it has some open questions, but at $297.70 per share (or 23.8× forward P/E), is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.