PulteGroup (PHM)

134.87

+0.25 (0.19%)

NYSE · Last Trade: Feb 26th, 2:47 PM EST

Falling mortgage rates should be a boon for homebuilder stocks.

Via The Motley Fool · February 25, 2026

Mid-cap stocks have the best odds of scaling into $100 billion corporations thanks to their tested business models and large addressable markets.

But the many opportunities in front of them attract significant competition, spanning from industry behemoths with seemingly infinite resources to small, nimble players with chips on their shoulders.

Via StockStory · February 24, 2026

The U.S. economy in February 2026 has become a study in contradictions, presenting a "mixed bag" of data that has effectively paralyzed the Federal Reserve’s immediate policy path. Recent reports highlight a cooling industrial sector, with the Manufacturing Purchasing Managers' Index (PMI) softening to 51.9, a sign

Via MarketMinute · February 24, 2026

PulteGroup Inc. (NYSE:PHM) Passes Peter Lynch's GARP Investment Filterchartmill.com

Via Chartmill · February 21, 2026

PulteGroup Inc (NYSE:PHM) Passes Key Peter Lynch Investment Screenchartmill.com

Via Chartmill · January 30, 2026

PulteGroup Inc (NYSE:PHM) Tops Q4 Earnings Estimates Amid Market Shiftschartmill.com

Via Chartmill · January 29, 2026

President Donald Trump has officially nominated former Federal Reserve Governor Kevin Warsh to succeed Jerome Powell as Chair of the Federal Reserve, a move that signals a seismic shift in American monetary policy. As Powell’s term approaches its May 2026 expiration, the selection of Warsh—a figure synonymous with

Via MarketMinute · February 20, 2026

The American housing market, long shackled by the "lock-in effect" and a multi-year inventory drought, showed unexpected signs of a robust thaw this week. In a report released by the U.S. Census Bureau on February 18, 2026, housing starts for the previous period jumped a staggering 6.2%, signaling

Via MarketMinute · February 19, 2026

The financial markets received a sobering wake-up call on February 19, 2026, as the Federal Reserve released the minutes from its January policy meeting. The documents revealed a central bank increasingly wary of "sticky" inflation, signaling a definitive pause in the interest rate-cutting cycle that many investors had hoped would

Via MarketMinute · February 19, 2026

In a morning report that has sent a jolt of optimism through the financial markets, the U.S. Census Bureau and the Department of Housing and Urban Development revealed today, February 18, 2026, that the American housing sector is performing with unexpected vigor. Both Housing Starts and Building Permits for

Via MarketMinute · February 18, 2026

The U.S. housing market faced a sobering reality check this week as the National Association of Home Builders (NAHB)/Wells Fargo (NYSE: WFC) Housing Market Index (HMI) slumped to a reading of 36 for February 2026. This unexpected decline, down from 37 in January, marks the 22nd consecutive month

Via MarketMinute · February 18, 2026

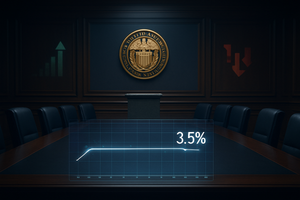

As the financial world braces for the release of the January Federal Open Market Committee (FOMC) meeting minutes tomorrow, February 18, 2026, investors are meticulously scanning the horizon for any signals regarding the future path of U.S. monetary policy. With the federal funds rate currently held at a target

Via MarketMinute · February 17, 2026

In the upper echelons of the American homebuilding industry, NVR, Inc. (NYSE: NVR) has long been regarded as the gold standard of capital efficiency. However, the market’s reaction in mid-February 2026 has left even seasoned analysts scratching their heads. On February 11, 2026, NVR’s board approved a fresh $750 million share repurchase authorization—a move that [...]

Via Finterra · February 16, 2026

Following the release of a robust January jobs report that exceeded all Wall Street expectations, President Donald Trump has reignited his aggressive campaign against current Federal Reserve policy, calling for the United States to implement the “lowest interest rates in the world.” The President’s remarks, punctuated by a celebratory

Via MarketMinute · February 12, 2026

There is a homebuilding shortage in the United States, and it represents a powerful secular trend worth investing in

Via The Motley Fool · February 11, 2026

PulteGroup’s fourth quarter saw a positive market reaction as the company delivered revenue above Wall Street’s expectations, despite notable declines in both sales and profit margins. Management attributed the quarter’s performance to continued strength in its geographically diverse operations—especially in the Midwest, Northeast, and Florida—where demand has held up better than in Texas and Western markets. CEO Ryan Marshall emphasized the benefits of the company’s diversified buyer base, noting a 14% year-over-year increase in active adult sign-ups in the quarter. He also highlighted that Del Webb communities, which target active adults, generated the highest gross margins and played a key role in offsetting softness among first-time and move-up buyers.

Via StockStory · February 5, 2026

Following a turbulent period of political gridlock and fiscal uncertainty, new data released by the U.S. Census Bureau on January 21, 2026, reveals that U.S. construction spending rose by 0.5% in October 2025. This increase brought the seasonally adjusted annual rate to $2.175 trillion, a figure

Via MarketMinute · January 30, 2026

Homebuilding company PulteGroup (NYSE:PHM) reported revenue ahead of Wall Streets expectations in Q4 CY2025, but sales fell by 6.3% year on year to $4.61 billion. Its non-GAAP profit of $2.88 per share was 2.6% above analysts’ consensus estimates.

Via StockStory · January 30, 2026

Shares of homebuilding company PulteGroup (NYSE:PHM) jumped 3.5% in the afternoon session after the company reported mixed fourth-quarter results, where a strong revenue beat appeared to outweigh an earnings shortfall.

Via StockStory · January 29, 2026

PulteGroup (NYSE: PHM) reported Q4 earnings and revenue above analyst expectations. Net income of $502M, adjusted EPS of $2.88.

Via Benzinga · January 29, 2026

PulteGroup (PHM) Q4 2025 Earnings Call Transcript

Via The Motley Fool · January 29, 2026

Homebuilding company PulteGroup (NYSE:PHM) reported Q4 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 6.3% year on year to $4.61 billion. Its GAAP profit of $2.56 per share was 9.5% below analysts’ consensus estimates.

Via StockStory · January 29, 2026

In a move that underscored the complexity of the current "Great Normalization" era, the Federal Reserve concluded its first meeting of 2026 by electing to hold the federal funds rate steady at the 3.5%–3.75% range. This decision, announced today, January 28, 2026, marks a definitive pause in

Via MarketMinute · January 28, 2026

Homebuilding company PulteGroup (NYSE:PHM) will be reporting results this Thursday before market hours. Here’s what investors should know.

Via StockStory · January 27, 2026